Press Release

Beer Ordering Data Shows Continued Industry Improvement in December

ALEXANDRIA, Va. – The National Beer Wholesalers Association (NBWA) released the Beer Purchasers’ Index (BPI) for December 2023.

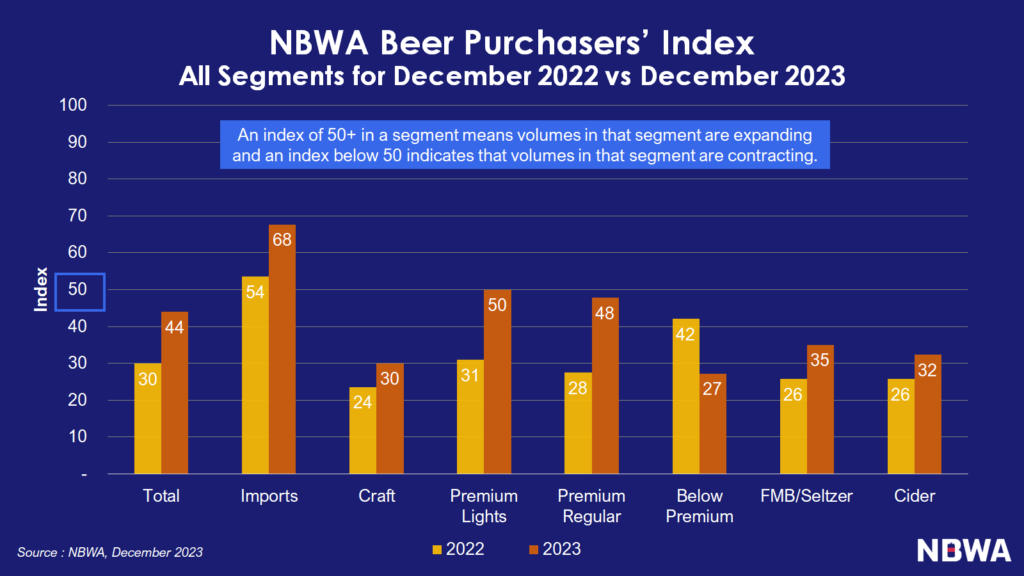

The U.S. beer industry closed out 2023 with its third straight month of improved overall ordering trends compared to 2022. The December BPI dipped below the benchmark (50) to 44, signaling contracting volumes, but represents a 14-point increase from the December 2022 reading.

December is the seventh straight month in which at least five of the seven measured segments saw increased ordering compared to 2022, with three segments (Imports, Premium Lights and Premium Regular) recording double-digit growth.

While the combination of readings for the BPI (44) and at-risk inventory (47) measures indicate a somewhat cautious outlook heading into 2024, the overall data reflects a healthier ordering environment compared to this time last year.

Looking across the segments for December:

- The index for imports continues to point to expanding volumes with the December 2023 reading of 68 higher than the December 2022 reading of 54.

- The craft index at 30 for December 2023 continues to signal contraction in this segment; however, it is slightly higher than the December 2022 reading at 24.

- The premium light index rose to 50 for December 2023, also above the December 2022 reading at 31.

- The premium regular index rose to 48 for December 2023, above the December 2022 reading at 28.

- The below premium segment for December 2023 fell to 27 and is the only segment lower than its December 2022 reading (42).

- The FMB/seltzer reading for December 2023 at 35 is higher than the December 2022 reading at 26.

- Finally, the cider segment posted a December 2023 reading at 32 compared to 26 for December 2022.

###

The National Beer Wholesalers Association (NBWA) represents America’s 3,000 independent beer distributors who service every state, congressional district and media market across the country. Licensed at the federal and state levels, beer distributors get bottles, cans, cases and kegs from a brewer or importer to stores, restaurants and other licensed retail accounts through a transparent and accountable regulatory system. Distributors build brands of all sizes – from familiar domestic beers to new startup labels and imports from around the world – and generate enormous consumer choice while supporting more than 140,000 quality jobs in their home communities. Beer distributors work locally to keep communities safe by sponsoring programs to promote responsible consumption, combat drunk driving and reduce underage drinking.