Policy Issue

Apr 01, 2025

Bonus Depreciation (Full and Immediate Expensing) & Interest Deductibility

Expires at the End of 2025

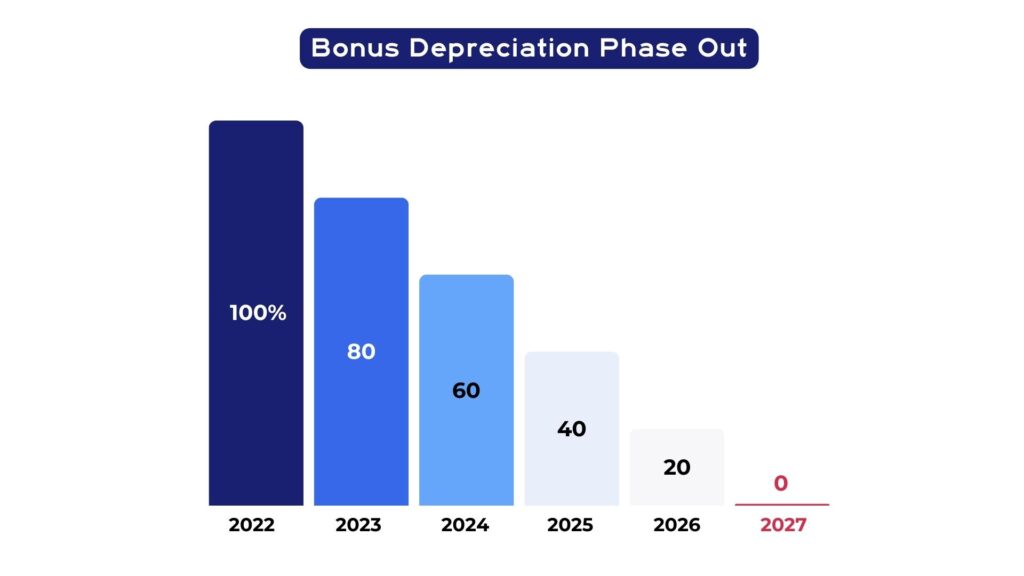

Bonus depreciation allows businesses to deduct the cost of new qualified investments in equipment, facilities and vehicles. It is being phased out now and will be fully phased out by 2027. Interest deductibility encourages community investment by enabling businesses to reduce related financing costs.

We Encourage Congress to:

Cosponsor the Accelerate Long-term Investment Growth Now (ALIGN) Act (H.R. 574/S. 187)

This would make full expensing of qualified equipment permanent. Contact:

- Rep. Arrington: Jonathan.Kupperman@mail.house.gov, 202-225-4005

- Sen. Lankford: Jesse_Mahan@lankford.senate.gov, 202-224-5754