Press Release

NBWA Releases Beer Purchasers’ Index for August 2020

Media contact: Erin Donar | EDonar@nbwa.org | 703-229-3702

ALEXANDRIA, Va. — Today, the National Beer Wholesalers Association (NBWA) released the Beer Purchasers’ Index (BPI) for August 2020 as beer distributors continue to take an aggressive stance in their ordering to minimize out-of-stocks and compensate for lost draft beer volumes and on-premise closures.

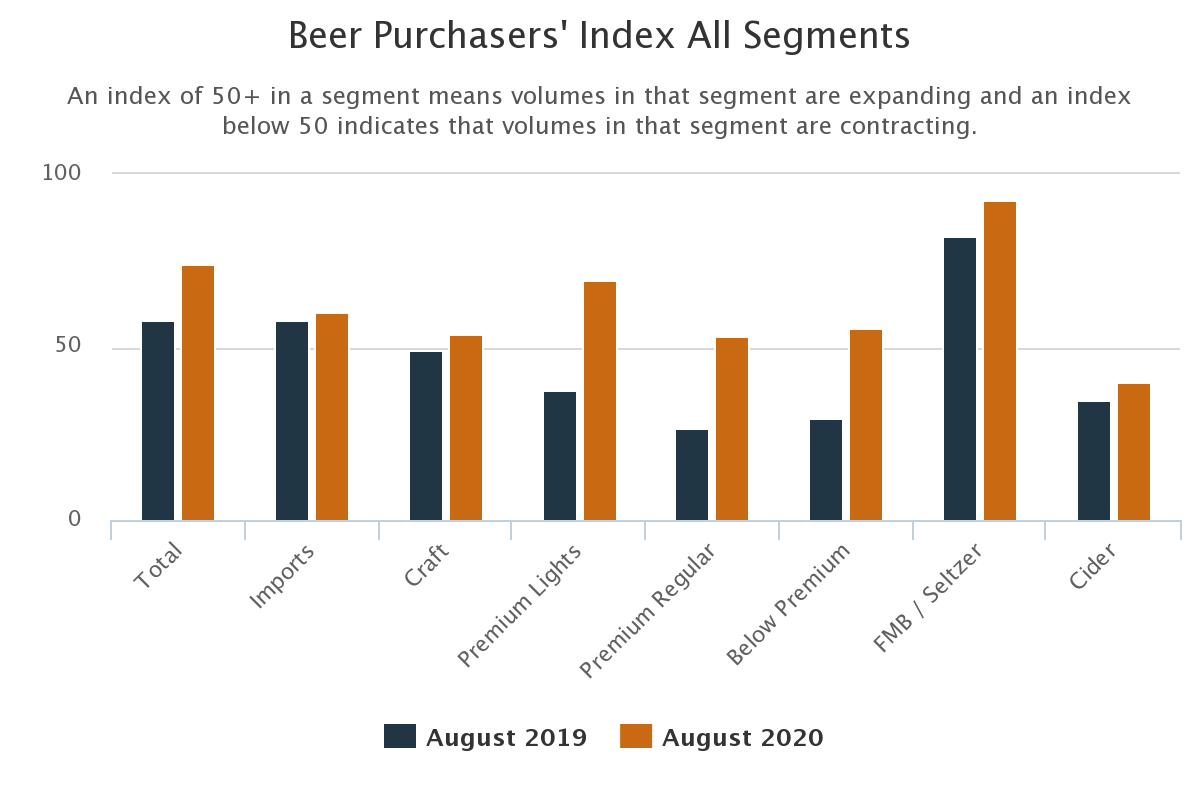

The total Beer Purchasers’ Index for August 2020 rose to 74 from 58 for August 2019.

The “at-risk inventory” index for total beer (inventory at risk of going out-of-code in the next 30 days) continues to record all-time low readings at 22 for August 2020 from 46 in August 2019.

NBWA Chief Economist Lester Jones explained, “The August 2020 reading remains significantly above historical trends as increased packaged beer sales in the off-premise continue to ‘fill-in’ for lost on-premise and draft beer sales.”

BPI is the only forward-looking indicator for distributors to measure expected beer demand. The index surveys beer distributors’ purchases across different segments and compares them to previous years. A reading greater than 50 indicates the segment is expanding, while a reading below 50 indicates the segment is contracting.

Looking across the segments:

- The index for FMBs/seltzers at 92 remains the strongest of all segments in the survey, with a 10-point increase over the 82 reading in August 2019.

- The index for imports at 60 also remains in expansion territory for August 2020 and now slightly higher than last year’s reading of 58.

- The craft index for August rose above the 50 break-even mark to 54 and is slightly higher than the August 2019 reading of 49.

- Across the domestic beer segments, premium lights, regulars and below premiums all continue to post historically high readings in August and continue on a 5-month streak. Premium lights at 70 remain significantly elevated compared to the 38 mark for August 2019. The premium regular segment posted a 53 reading in August 2020 relative to 26 in August 2019. The below premium segment at 56 was also significantly higher than the August 2019 reading of 29.

- The cider segment remains in contraction territory, however, slightly higher at 40 in August 2020 from 34 at the same time last year.